Market Signals, Active SMAs, and a Stock Spotlight

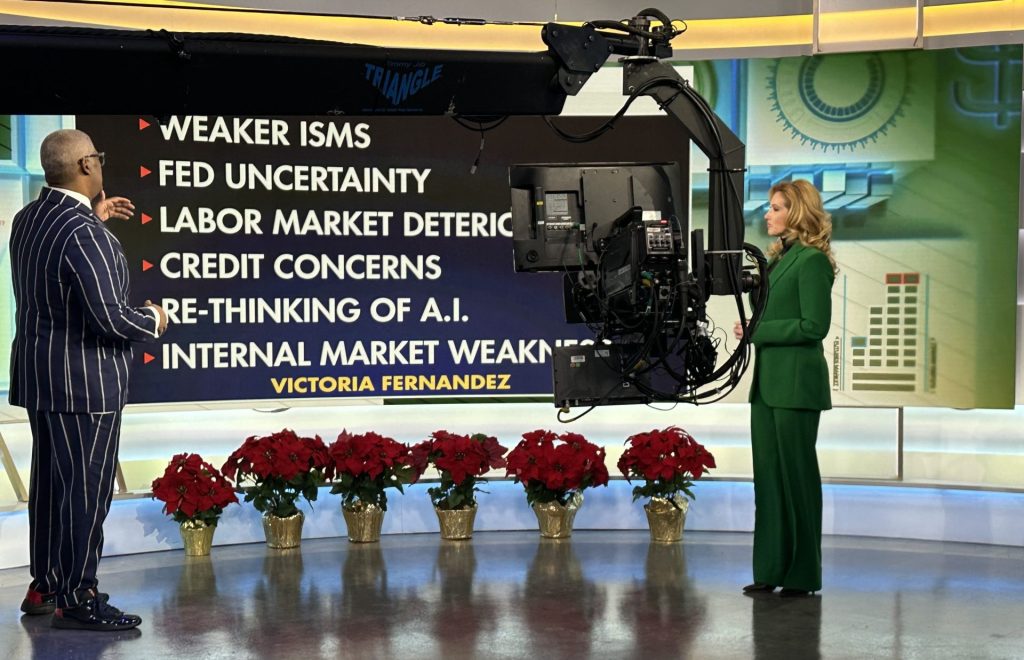

Victoria Fernandez on Fox Business’s Making Money With Charles Payne

Chief Market Strategist Victoria Fernandez, CFA, joined Fox Business’ Making Money With Charles Payne to discuss three themes around our current positioning. The full clip isn’t available, but below are the key points Victoria shared.

- Market outlook

The recent economic slowdown is showing early signs of improvement. If that continues, next year could benefit from stimulus and stronger earnings.

Why that matters:

A stabilizing backdrop supports selective opportunities. Investors need to stay flexible as conditions evolve.

- Active SMA approach for volatile markets

Crossmark’s actively managed SMAs allow us to make daily adjustments to stay aligned with our outlook, something index-based approaches don’t do.

Why that matters:

Daily oversight helps manage risk and keep portfolios positioned for changing markets.

- Stock spotlight

Gilead remains a strong fundamental holding with attractive valuation, solid cash flow, and a competitive dividend. The company also announced a new $3 million initiative to expand access to breast cancer education and medicine.

Why that matters:

The combination of strong fundamentals plus values alignment is our sweet spot. We invest based on fundamentals, but many of our strategies incorporate values factors. Gilead’s philanthropic commitment reflects the type of positive impact we like to see.

As Charles Payne notes at the end of the conversation, Crossmark is a faith-based firm offering values-based investments for investors who care about strong fundamentals and doing good.

Listen to a portion of the conversation on the Charles Payne Unstoppable Prosperity podcast: Victoria Fernandez interview.